🧾 What Is the Gazette About?

If your business is registered for VAT, your invoicing process is about to change.

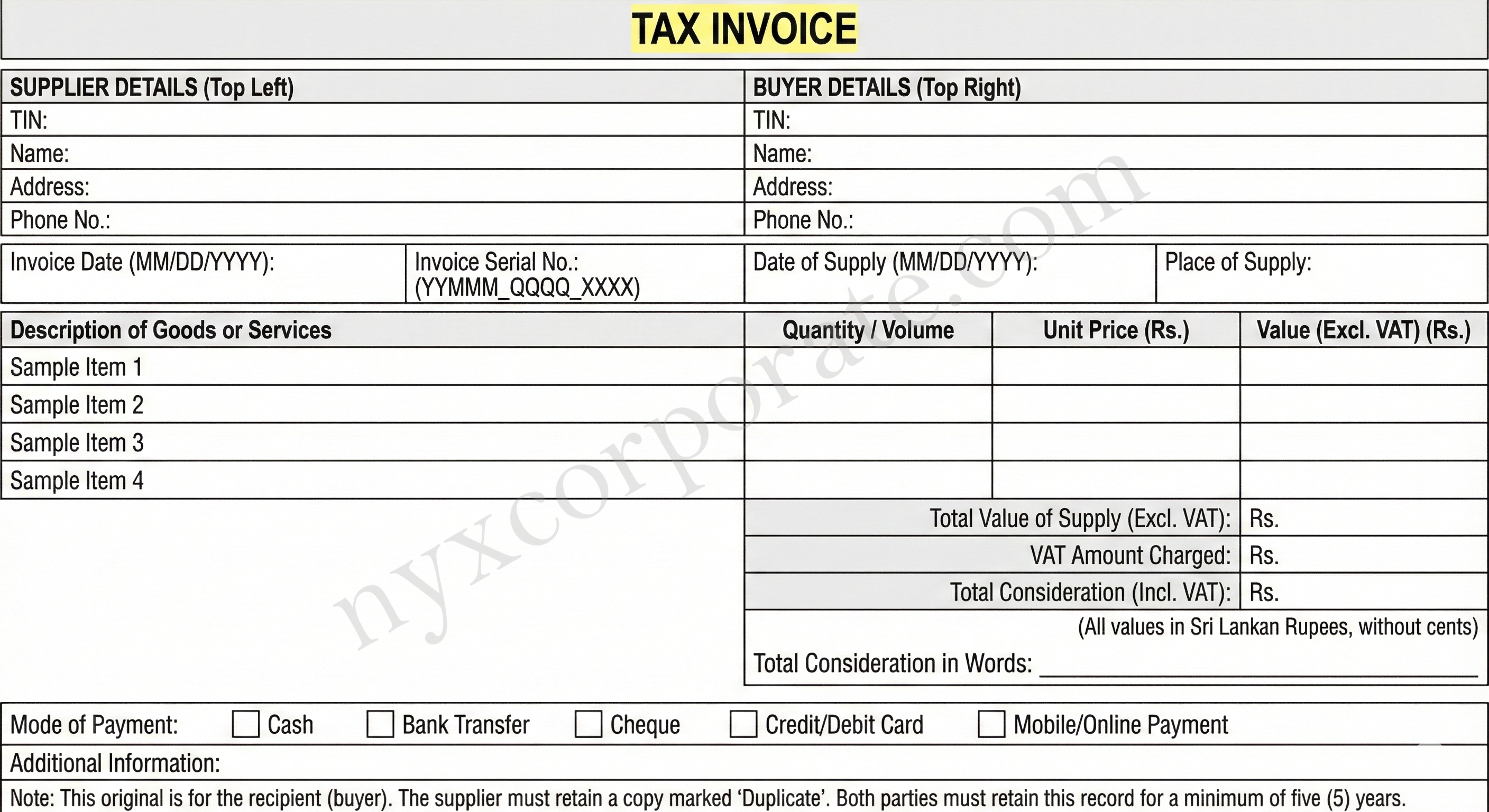

The Department of Inland Revenue has issued Gazette Extraordinary No. 2463/05, mandating a strict new format and specification for all Tax Invoices. These new regulations come into effect on January 01, 2026, meaning businesses have a limited window to update their stationery and accounting software.

At NYX Corporate Solutions, we have analyzed the directive to help you stay compliant. Here is what you need to know.

1. The “Tax Invoice” Label

Every invoice must clearly bear the title “Tax Invoice”. This text must be bold or highlighted and placed in a prominent position on the document.

2. The New Serial Number Logic (Critical Update)

All registered persons must adopt the following format for the invoice serial number: YYMMM_QQQQ_XXXX.

-

YY: The last two digits of the calendar year.

-

MMM: The first three letters of the month in English capitals.

-

QQQQ: An alphanumeric code for identifying organizational entities like branches or projects.

-

XXXX: The numerical sequence.

Example: An invoice issued in October 2025 by Branch 03 would look like: 25OCT_BR03_1. Note: The number must not contain spaces and cannot exceed 40 characters.

3. Layout & Essential Details

The invoice must include:

-

Supplier Details: TIN, Name, Address, and Telephone Number, placed in the Top Left corner.

-

Buyer Details: TIN, Name, Address, and Telephone Number, placed in the Top Right corner.

-

Date Format: All dates (invoice date and supply date) must be in the MM/DD/YYYY format.

-

Place of Supply: The location where the supply originates.

Sample invoice layout created based on the gazette’s guidelines.

4. Financial Values: No More Cents

The value of the supply must be stated in Sri Lankan Rupees without cent values. The value section must include the net amount (excluding VAT), the VAT charged, and the total consideration (including VAT). The total consideration must also be written in words.

5. Record Keeping

You are required to issue the original to the buyer and retain a copy marked “Duplicate”. These records must be preserved for at least five years from the end of the taxable period. The tax invoice should specifically only include goods and services that are subject to VAT.

What This Means for Your Business

If you use accounting software (like QuickBooks) or pre-printed invoice books, they will likely become non-compliant on January 1, 2026.

-

Software Users: Your system needs to be reconfigured to auto-generate the

YYMMMserial number format and remove cent values. -

Manual Invoicing: Your staff needs training on the new date formats and mandatory fields.

How NYX Can Help

Compliance isn’t just about filing returns; it is about getting the operations right.

Whether you need help reconfiguring your QuickBooks environment to match these new templates, require bookkeeping support to ensure your records meet the 5-year retention rule, or need expert TIN registration and individual tax support, we are here to assist.

Don’t wait until the deadline. 📩 Reach out today NYX Corporate Solutions to ensure your business transitions smoothly to the new 2026 regulations.

Expert Support. Seamless Compliance.

0 Comments